We could do this, but by having the Income Summaryaccount, you get a balance for net income a second time. This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts. If you put the revenues and expenses directlyinto retained earnings, you will not see that check figure. Nomatter which way you choose to close, the same final balance is inretained earnings. The income summary account is a temporary account solely for posting entries during the closing process.

- To get a zero balance in the Income Summaryaccount, there are guidelines to consider.

- Here you will focus on debiting all of your business’s revenue accounts.

- The purpose of closing entries is to prepare the temporary accounts for the next accounting period.

- This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary.

- To further clarify this concept, balances are closed to assure all revenues and expenses are recorded in the proper period and then start over the following period.

How much will you need each month during retirement?

Remember, dividends are a contra stockholders’ equity account.It is contra to retained earnings. The remaining balance in Retained Earnings is$4,565 (Figure5.6). This is the same figure found on the statement ofretained earnings. Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). The $1,000 net profit balance generated through the accounting period then shifts.

Close all revenue and gain accounts

Closing entries are mainly used to determine the financial position of a company at the end of a specific accounting period. Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Accounts are considered “temporary” when they only accumulate transactions over one single accounting period. Temporary accounts are closed or zero-ed out so that their balances don’t get mixed up with those of the next year.

Temporary vs Permanent Accounts

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Now, if you’re new to accounting, you probably have a ton of questions.

Journalizing and Posting Closing Entries

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Since QuickBooks automates the year-end close, you don’t have to get caught up with all of these manual entries unless something was to go wrong. Even then you can get a bit of help or an accountant to sort you out. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Closing Entry Types

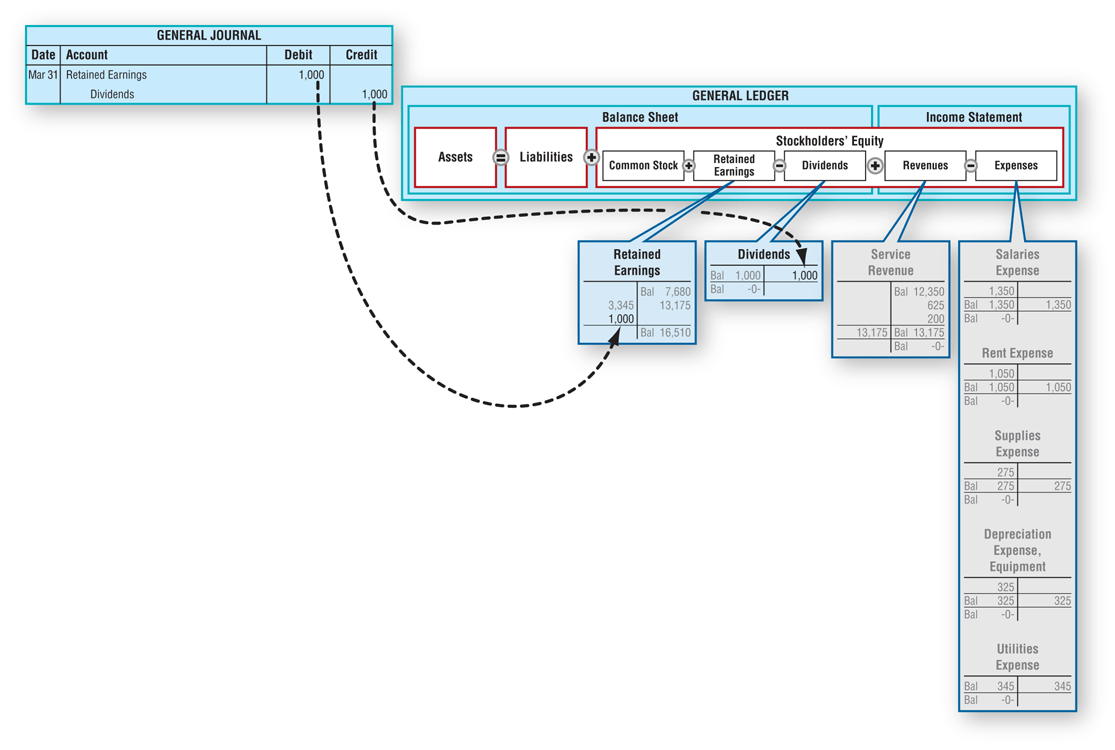

It isimportant to understand retained earnings is not closed out, it is only updated. RetainedEarnings is the only account that appears in the closing entriesthat does not close. You should recall from your previous materialthat retained earnings are the earnings retained by the companyover time—not cash flow but earnings. Now that we have closed thetemporary accounts, let’s review what the post-closing ledger(T-accounts) looks like for Printing Plus. Closing entries are posted in the general ledger by transferring all revenue and expense account balances to the income summary account. Then, transfer the balance of the income summary account to the retained earnings account.

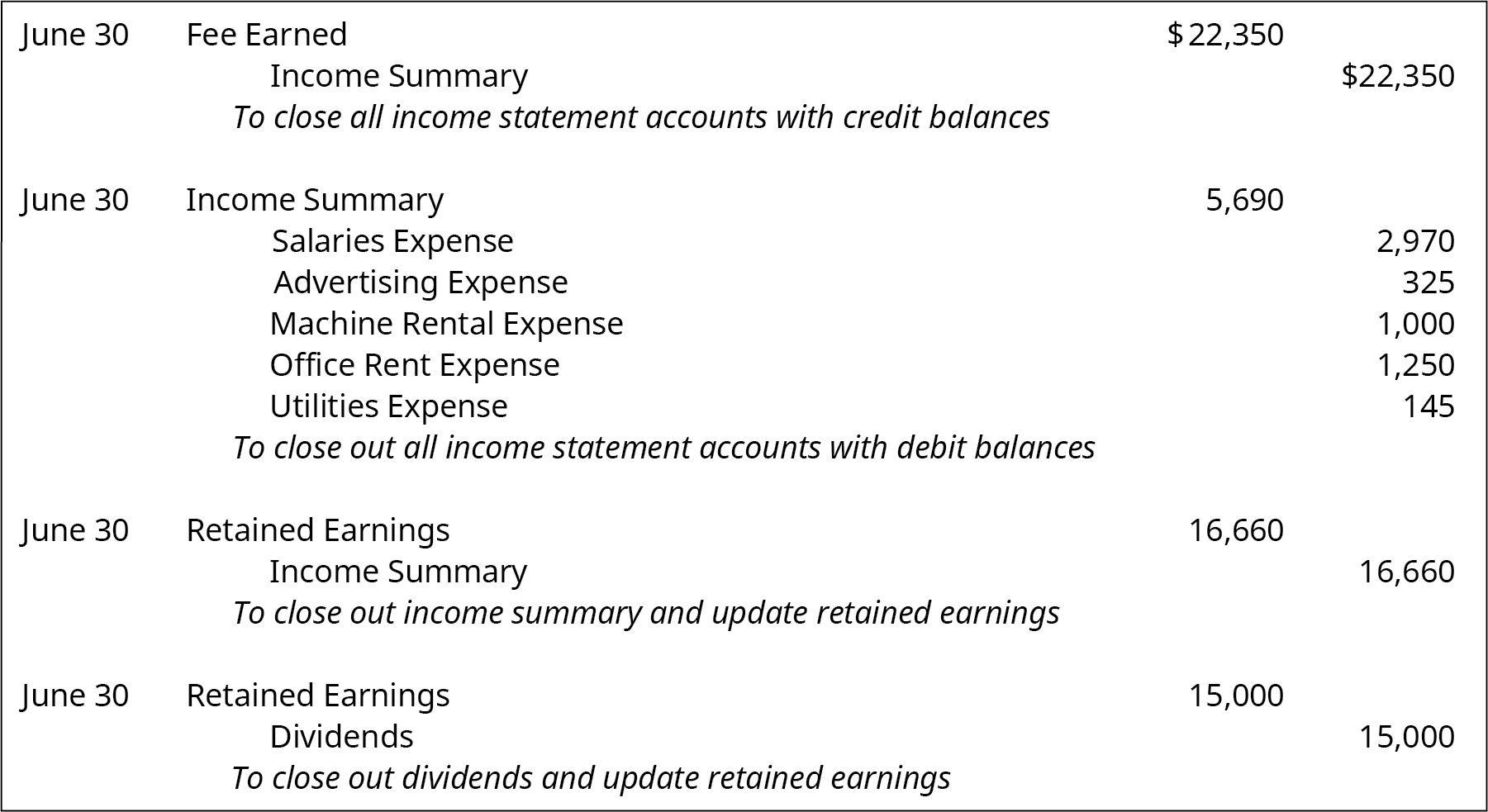

We want income statements to start every year from zero, but for accounts like equipment, debt, and cash accounts—reported on the balance sheet—we want to keep a running balance from the beginning of the business. The first entry requires revenue accounts close to the Income Summary account. To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary. Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary.

HighRadius has a comprehensive Record to Report suite that revolutionizes your accounting processes, making them more efficient and accurate. At the core of this suite is the Financial Close Management solution, which simplifies and accelerates financial close activities, ensuring compliance and reducing errors. Prepare the closing entries for Frasker Corp. using the adjusted trial balance provided. The fourth entry requires Dividends to close to the Retained Earnings account.

The total debit to income summary should match total expenses from the income statement. The first entrycloses revenue accounts to the Income Summary account. The secondentry closes expense accounts to the Income shared resources Summary account. Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period.

Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period, which is an application of the time period assumption. When making closing entries, the revenue, expense, and dividend account balances are moved to the retained earnings permanent account. If you own a sole proprietorship, you have to close temporary accounts to the owner’s equity instead of retained earnings. Now that all the temporary accounts are closed, the income summary account should have a balance equal to the net income shown on Paul’s income statement. Now Paul must close the income summary account to retained earnings in the next step of the closing entries.

They zero-out the balances of temporary accounts during the current period to come up with fresh slates for the transactions in the next period. Notice that the balances in the expense accounts are now zeroand are ready to accumulate expenses in the next period. The IncomeSummary account has a new credit balance of $4,665, which is thedifference between revenues and expenses (Figure5.5). The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement. To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero.