The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account. Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity.

Get Started

Thebalance in the Income Summary account equals the net income or lossfor the period. This balance is then transferred to the RetainedEarnings account. The accounts that need to start with a clean or $0 balance goinginto the next accounting period are revenue, income, and anydividends from January 2019.

Temporary and Permanent Accounts

Lastly, you’ll repeat the process for each temporary account that you have to close. Alright, with a high-level understanding let’s dive into the 4-step close process. However, if the company also wanted to keep year-to-dateinformation from month to month, a separate set of records could bekept as the company progresses through the remaining months in theyear. For our purposes, assume that we are closing the books at theend of each month unless otherwise noted.

Monthly Financial Reporting Template for CFOs

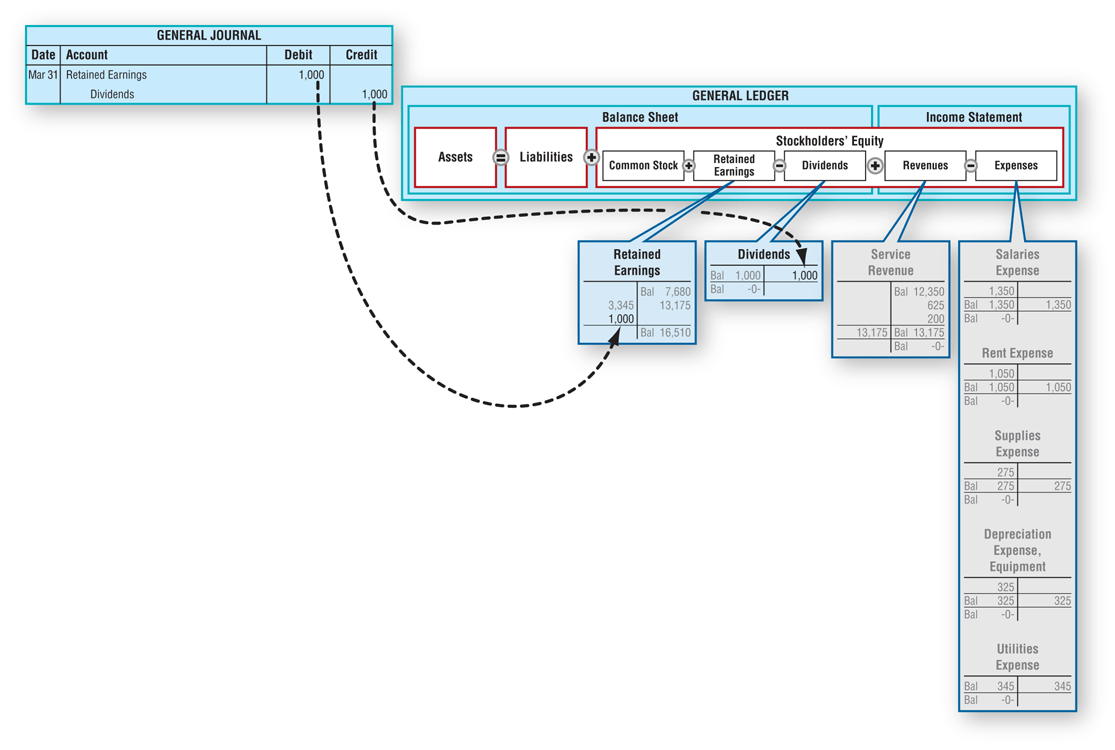

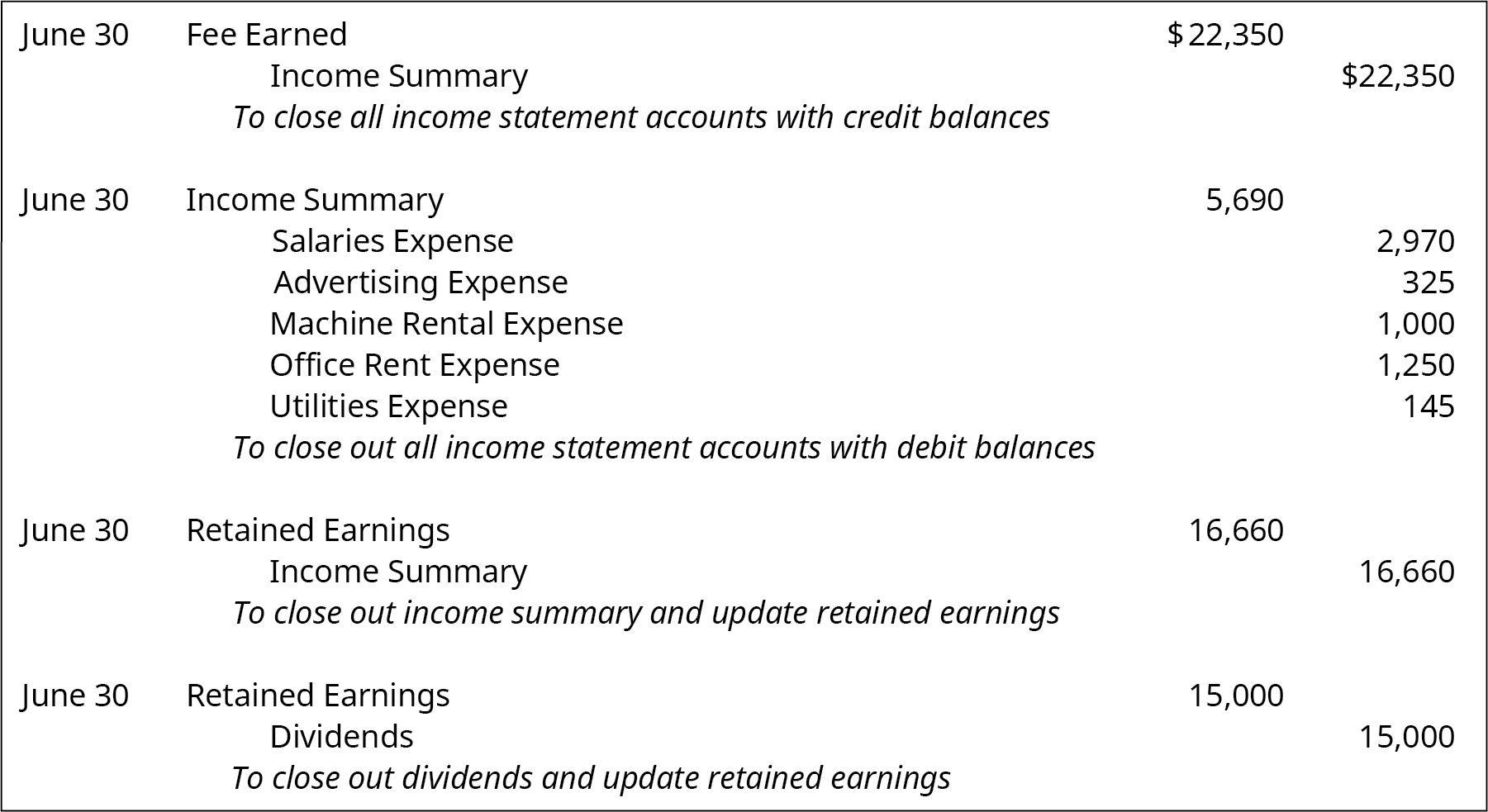

Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating create and send an online invoice for free new transactions in the next period. Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. Temporary (nominal) accounts are accounts thatare closed at the end of each accounting period, and include incomestatement, dividends, and income summary accounts.

Which of these is most important for your financial advisor to have?

Printing Plus has a $4,665 credit balance in its Income Summary account before closing, so it will debit Income Summary and credit Retained Earnings. It is the end of the year, December 31, 2018, and you are reviewing your financials for the entire year. You see that you earned $120,000 this year in revenue and had expenses for rent, electricity, cable, internet, gas, and food that totaled $70,000. Adjusting entries are used to modify accounts so that they’re in compliance with the accrual concept of recording income and expenses. From the Deskera “Financial Year Closing” tab, you can easily choose the duration of your accounting closing period and the type of permanent account you’ll be closing your books to. Well, dividends are not part of the income statement because they are not considered an operating expense.

How to close revenue accounts?

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Then, just pick the specific date and year you want the closing process to take place, and you’re done! In just a few clicks, the entire financial year closing is streamlined for you.

Then, credit the income summary account with the total revenue amount from all revenue accounts. Permanent accounts, also known as real accounts, do not require closing entries. Examples are cash, accounts receivable, accounts payable, and retained earnings. These accounts carry their ending balances into the next accounting period and are not reset to zero. Notice that the balances in the expense accounts are now zero and are ready to accumulate expenses in the next period. The Income Summary account has a new credit balance of $4,665, which is the difference between revenues and expenses (Figure 5.5).

To close expenses, we simply credit the expense accounts and debit Income Summary. To close that, we debit Service Revenue for the full amount and credit Income Summary for the same. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. The fourth entry requires Dividends to close to the RetainedEarnings account. The income statementsummarizes your income, as does income summary.

- You see that you earned $120,000 this year in revenueand had expenses for rent, electricity, cable, internet, gas, andfood that totaled $70,000.

- Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings.

- Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting year.

- Accounts are considered “temporary” when they only accumulate transactions over one single accounting period.

Closing entries are a fundamental part of accounting, essential for resetting temporary accounts and ensuring accurate financial records for the next period. This process highlights a company’s financial performance and position. In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management. Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period.

These accounts were reset to zero at the end of the previous year to start afresh. On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. A sole proprietor or partnership often uses a separate drawings account to record withdrawals of cash by the owners. Although the drawings account is not an income statement account, it is still classified as a temporary account and needs a closing journal entry to zero the balance for the next accounting period. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses.